In Japan, there’s a consumption tax of 10% (since October 2019), or 8% for some items, that can be exempted under certain conditions. This can be a great deal for tourists who are leaving Japan less than 6 months after their arrival. Everything is so different in Japan that you’ll probably want to leave with your luggage full of souvenirs. Although tax exemption is a great deal, there are certain conditions to respect and one of the main concerns regards the right to open or not the items you bought in Japan.

Tax-free items cannot be opened in Japan if they are consumable items, and are in a sealed bag during the purchase. If the bag is opened in Japan, even though the products weren’t used, the purchaser will need to pay the consumption tax during the customs procedure.

Now, you must be thinking: “But how do I know what are consumable items?”. Don’t worry, in the next paragraphs, I’m going to explain to you what they are and some examples of purchases that can be tax-free or not. I’m also going to explain to you what you should do to claim the tax exemption.

What Are Consumable Items And General Items?

Tax-free is not applied under the same conditions for consumable items and general items. This is why it is important to know the difference between both.

Consumable items are intended to be used relatively quickly like drinks, food, cosmetics, tobacco, and medicines for example. I guess you could say that these are items with an expiration date, and you’re not going to keep them forever. By the way, if you want to know if you can bring OTC medicines or vape to Japan, you might want to read my articles about these two subjects:

General items, on the other hand, are all the other items that you could keep forever, even if that doesn’t happen very often. Some examples of general items are home appliances, accessories, jewelry, shoes, clothes, and all those kinds of things.

Now that you’re starting to see more clearly the difference between each type, let’s talk about the conditions necessary to claim a tax-free purchase in Japan.

Hey, check out these recommendations I have for you!

Before going any further, take a look at some of the recommendations I've handpicked for you. I think these are essential items you should have on your trip to Japan. You can check them out and buy them directly from Amazon.

|

|

|

| A universal travel adapter | A 10,000 mAh power bank | A travel adapter and converter |

Regarding consumable items, the conditions for tax-free are:

- Minimum purchase of 5,000 (excluding tax)

- Items can’t be used in Japan and are put in a sealed bag that can’t be opened

- Maximum purchase of 500,000 yen

- You must leave Japan with your items less than 6 months after your arrival (if you’re staying for more than 6 months, you can’t benefit)

Regarding general items, the conditions for tax-free are:

Dreaming of Japan? Here’s your go-to guide for a great trip.

Download Free Guide

- Minimum purchase of 5,000 (excluding tax)

- Items can be used in Japan

- Maximum purchase unlimited

- You must leave Japan with your items less than 6 months after your arrival (if you’re staying for more than 6 months, you can’t benefit)

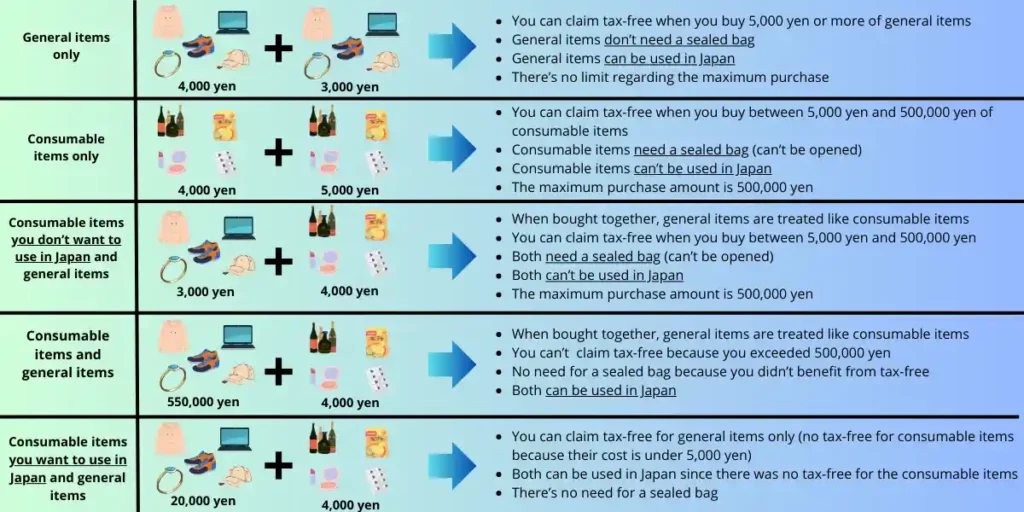

Nothing really complicated, right? Well, when you buy only one type of item, the rules are pretty simple. The problem is that you are likely to buy general items and consumables at the same store. What happens if you buy a tee shirt (general item) and a box of chocolates as a gift for someone (consumable item) at the same store? It all depends on the price of each item and what you intend to do with the tee shirt (use it in Japan or not?).

If I lost you here, it’s normal. The first time I tried to figure out when a mixed purchase of consumable and general items benefited from tax-free or not, I had a hard time, too. Let’s see some examples, so you can have all the information you need.

Klook.comYou may also like:

Can I Use my Debit Card in Japan?

Can I Take Paracetamol And Other OTC Medicines to Japan?

Can I Bring Vape to Japan?

What if I Buy General Items and Consumable Items in the same purchase?

The most important thing you need to keep in mind when buying a mix of consumable items and general items in the same purchase is that general items will be treated like consumable items. This means that they will be packed in a sealed bag, therefore they can’t be used in Japan, and you can’t exceed the 500,000 yen limit in the purchase.

For example, let’s imagine you buy a pair of shoes (4,000 yen) and a bottle of sake (4,000 yen) on the same day at the same store. How this purchase will be treated as tax-free?

- The pair of shoes is a general item and the bottle of sake is a consumable item, but since you’re buying them together, the pair of shoes will be treated like a consumable item.

- The total purchase is 8,000 yen. You can benefit from the tax-free because your purchase is between 5,000 yen and 500,000 yen.

- You can’t use your pair of shoes in Japan because they are treated like a consumable item in your purchase.

What if you need a pair of shoes in Japan? In that case, you can’t benefit from the tax-free because they will be treated separately, and each one costs 4,000 yen. Purchases under 5,000 yen can’t benefit from tax-free.

Please check the image above which has some examples, and it might be easier to understand using images. But if you have any doubts, you can leave a comment, and I’ll try to help you.

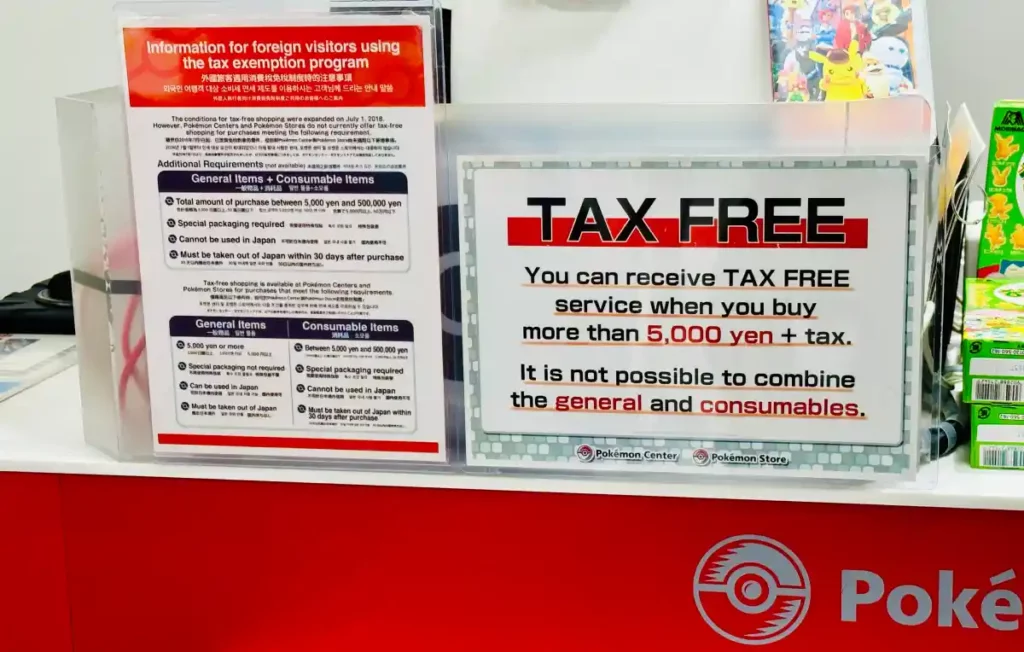

Also, be careful when buying general and consumable items in the same purchase because some stores may not allow a tax refund in those cases (like Pokémon Center, for example). Always ask before buying to avoid unpleasant surprises.

Klook.comHow do I Claim The Tax Exemption?

Please notice that tax exemption is not available everywhere in Japan. You will have to search for specific stores, malls, etc., that are identified with “tax-free” logos. If you have a doubt, check with the store first.

There are two ways of getting tax-free items in Japan:

- You can buy items at the tax-free price at the store (please check this possibility with the store first).

- You can buy items at the regular price and go to a tax-free counter for a refund (please look for tax-free counters and check with them which stores you should use).

Since they can be difficult to find, here’s a list of tax-free stores and tax-free counters to save you some time. There are probably other stores that are not listed, so keep your eyes open in Japan to spot some new stores.

Dreaming of Japan? Here’s your go-to guide for a great trip.

Download Free Guide

To buy tax-free items directly at the store, you have to:

- Show your original passport with the stamp of temporary traveler (make sure you get your stamp at the airport, even if you use the automatic gates. You have to find an immigration officer after the gates to get the stamp on your passport)

- Sign the “Covenant of Purchaser”

If the stores work with tax-free counters, to get a refund you have to:

- Claim tax-free on the day of purchase (you can’t do it the next day)

- Show your original passport with the stamp of temporary traveler (make sure you get your stamp at the airport, even if you use the automatic gates. You have to find an immigration officer after the gates to get the stamp on your passport)

- Show your purchased items

- Show the purchase receipt (written receipt not allowed)

- Show the credit card used for the payment

Whether you get your tax-free directly at the stores or the tax-free counter, a receipt will be attached to your passport, so you can show it at Customs when you’re leaving Japan.

Since April 1, 2020, Japan has started implementing the computerization of tax exemption. This system replaces the signed “Covenant of Purchaser” and the receipt attached to your passport, but you will have to show your passport to the Customs when leaving Japan anyway.

Please notice that you can also benefit from the liquor tax exemption at approved breweries, wineries, and distilleries (not possible in supermarkets, department stores, or liquor stores, for example). There aren’t many approved stores, but you can find a list here.

The liquor tax exemption respects the same conditions applied to consumable items (sealed bag, can’t be opened in Japan, purchase between 5,000 yen and 500,000 yen).

Hopefully, now you will be able to prepare for your shopping adventure in Japan and master the tax-free advantages. If you have any doubts, please leave a comment below and I’ll try to help.

Klook.com

Hi, just to check, what if I bought 2 general items but the staff puts them in a sealed bag? Can I remove them from the bag? It’s just a cap and a usj headband :/

Hi Xh,

If you bought only general items, you can open the sealed bag because general items can be used in Japan. BUT if there are also consumable items in the sealed bag, then you can’t open the sealed bag even if it is only to remove the general items. When bought together with consumable items, general items are treated as consumable items too.

Hi

Can I ask the store to remove the packaging to reduce the bulk before the duty free bag is sealed ?

Hi Carolyn,

I guess you could ask, but I never saw anyone do it before. I’m afraid that could be perceived as a little rude, too. If there aren’t many customers in the shop and there’s no one else waiting, you may try. However, I would avoid that type of request in a crowded shop. Please notice that this is only my personal opinion, not the law.

Hope this helps!

Ana

Hey, I bought a pair of headphones and nothing else and claimed tax-free on them. Can I open them and use them in Japan? The headphones do have a box and is in a shopping with a small piece of tape sealing in the middle.

Hello Jessica,

According to the law, if you only bought a “general item”, you have the right to use it in Japan.

Hey, I hope you can help. We didn’t know about all those rules and bought a suitcase and some other stuff (consumable and non-consumable). The other stuff is in bags sealed. But my boyfriend (tourist) wanted to gift me the suitcase (temporary resident). Now we want to just pay the tax for these items but it was not possible in the store afterwards. And we don’t know if we can just use all the stuff and leave the suitcase on Japan. And then he just need to pay the tax when flying home.

I cannot really find any information about it. On how to revert the tax exemptions basically.

Hope you can help.

Great article btw. Wished I knew it before Q_Q

Hello Taeko,

Please refer to this information:

https://www.nta.go.jp/publication/pamph/shohi/menzei/201805/pdf/explanation_eng.pdf

https://www.nta.go.jp/publication/pamph/shohi/menzei/201805/pdf/0021009-040_09.pdf

I believe that the person who has bought a tax-free item will have to pay the consumption tax at customs when leaving Japan.

Hi, pls help, so I didn’t know that you can’t open the seal bag from a tax free items at don quijote, I accidentally opened it because i wanted to check what i got. What do i do? Will i just have to give the tax back to the airport?

Hello Edel,

Please refer to this information:

https://www.nta.go.jp/publication/pamph/shohi/menzei/201805/pdf/explanation_eng.pdf

https://www.nta.go.jp/publication/pamph/shohi/menzei/201805/pdf/0021009-040_09.pdf

I believe that you will have to pay the consumption tax at customs when leaving Japan.

Hi Anna. I purchased a tax free item and based on your article, this is under general items and on a single receipt purchase. My question is can i remove it on its original box and put it on my luggage? The box is overkill.

Hi!

According to the law, if you only bought a “general item”, you have the right to open it and even use it in Japan, but remember that when you leave Japan, you must show your tax-free items at the Customs for inspection. This can be a little tricky if you put your tax-free items in the checked luggage (it’s always better to keep tax-free items in the hand luggage, when possible). I’ve seen people buying lots of things and not presenting the items at the Customs. Apparently, they didn’t have any issues doing it, but this is not the correct way of handling tax-free items.

Hi I’ve bought an iPhone from Japan and was hoping to use it while I’m here and take back with me to Australia. Would this be ok?

Hi,

I believe Apple doesn’t sell tax free products, so there’s no issue using and taking back the iPhone with you regarding tax free rules. However, I would check at least if the iPhone is not simlocked before leaving.

I accidentally used a product from the sealed bag from don quijote. Now I am worried if I leave Japan, so how do I fix the problem?

Hi Celestine,

Please refer to this information:

https://www.nta.go.jp/publication/pamph/shohi/menzei/201805/pdf/explanation_eng.pdf

https://www.nta.go.jp/publication/pamph/shohi/menzei/201805/pdf/0021009-040_09.pdf

You can pay the consumption tax at customs when leaving Japan.

According to the law, if you bought a “general item”, you have the right to open it and even use it in Japan, but if the bag also had “consumable items”, this is where things get tricky. If the item you used was a general item, I wouldn’t worry, because you have the right to use those. However, if it was a consumable item, you should present the information to the customs and pay the consumption tax. They won’t make a huge deal if you only used 1 product. What Japanese customs don’t want is tourists buying tax-free consumable items and giving them to locals.

Hope this helps!

Ana